Wake County Property Tax Rate 2024 Calculation Chart – Local governments must disclose the “revenue-neutral” tax rate, or rate that would generate the same amount of money with the new, higher values. Wake County created a calculator to help property . Homeowners in multiple towns across Wake County could see their property taxes jump later this year, as home values have spiked from four years ago, according to the latest property revaluations. Wake .

Wake County Property Tax Rate 2024 Calculation Chart

Source : www.wake.gov

Wake County, NC Property Tax Calculator SmartAsset

Source : smartasset.com

Revenue Neutral Tax Rate | Wake County Government

Source : www.wake.gov

Wake County revaluation results: home, commercial values soar

Source : www.newsobserver.com

Schedule of Values | Wake County Government

Source : www.wake.gov

Appeals: Informal Review and Formal Appeal | Wake County Government

Source : www.wake.gov

New property value notices to hit Wake County mailboxes starting

Source : www.wake.gov

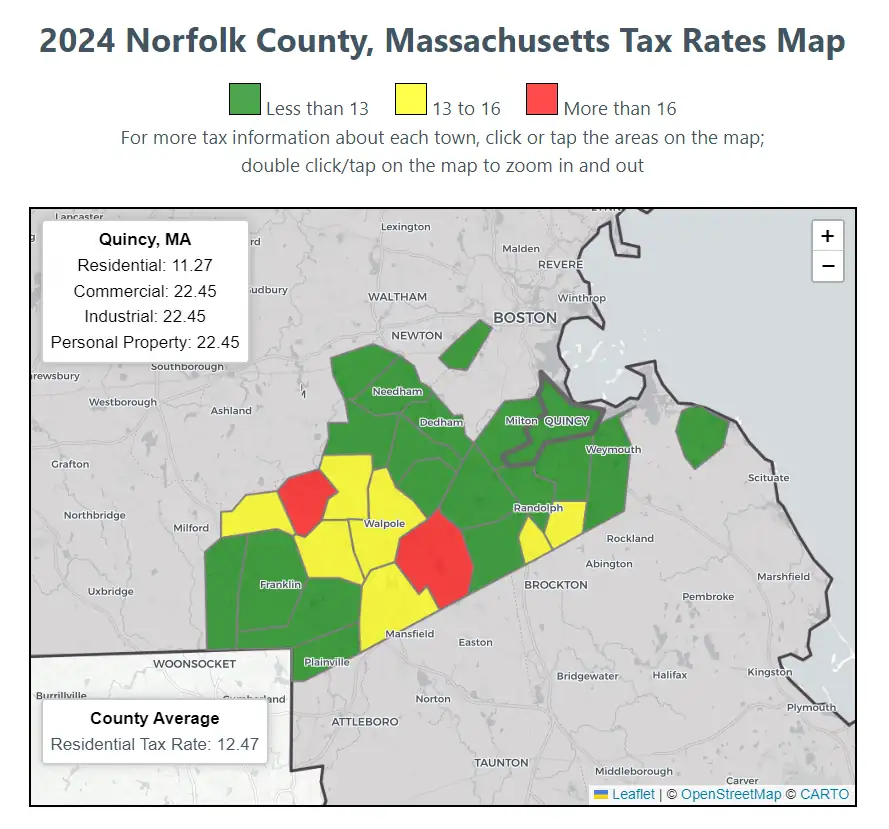

2024 Norfolk County Massachusetts Property Tax Rates | Residential

Source : joeshimkus.com

How To Charge Sales Tax in the US (2024) Shopify USA

Source : www.shopify.com

Wake County homeowners brace for property tax adjustments: What to

Source : www.wral.com

Wake County Property Tax Rate 2024 Calculation Chart New property value notices to hit Wake County mailboxes starting : You can contact the tax administration to send a duplicate if you misplaced it. The mailing address is: Wake County Tax Administration Attention: 2024 Real Estate Revaluation PO Box 2331 . While it’s very likely Wake County with a $1,176 property tax In 2024, it would be worth $300,000 with a $1,393 property tax In the same time, because of the lowering tax rate, tax bills .